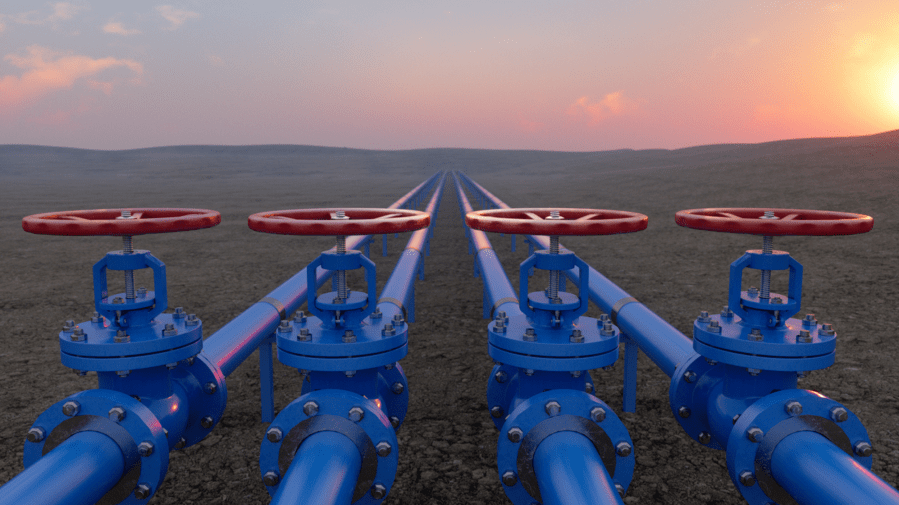

Bidirectional Natural Gas Distribution System Design 2 Way Feeds

Energy is the lifeblood of modern society. We use it to heat and cool our homes, make factories hum, and transport ourselves from place to place. Energy is always and everywhere in demand.

Because it is so important, investing in energy would likely be a good idea for profit. As always, the devil is in the details. In the case of energy investing, more and more people are focused on green forms of energy, those that are perceived to pollute less and might be friendlier to the environment. Natural gas is one of the cleanest, high demand, and widely used forms of clean energy.

When many folks think about energy investing, the first thoughts that might come to mind are the oil companies. Energy companies, particularly the major oil companies like Exxon and Valero, have come under heavy scrutiny over the last several decades — causing many people to become reticent to invest in them.

Oil is only one type of hydrocarbon used for fuel and energy. Natural gas is another and a very important one at that. Natural gas, also known as methane, is the earth's cleanest fossil fuel. It is colorless and odorless in its natural state.

Types of Clean Energy

What is actually pretty impressive is that there are a wide variety of ways to obtain energy for society's needs. In addition to oil and gas, there are nuclear, wind, hydroelectric, coal, tidal, and solar energy sources, among others.

Some of these are termed "green energy" sources, largely because they don't emit as much greenhouse gas into the atmosphere as oil. Solar, wind, and hydroelectric are good examples of green energy sources. Among the carbon-based energy sources, natural gas is the cleanest when it comes to greenhouse gas emissions.

Natural Gas: America Has it in Abundance

Of all the green energy sources, natural gas has several major advantages. First of all, America has natural gas in abundance. Secondly, there is a developed infrastructure in place to transport it all across the country and beyond. Thirdly, natural gas provides a very high amount of energy per unit volume.

The United States is greatly endowed with natural gas reserves. Natural gas is measured as a volume and the technical unit of measure that is used is a cubic foot. America had 473.3 trillion cubic feet (Tcf) of natural gas reserves at the year-end of 2020. To most folks, this number is hard to fathom, but suffice to say, it is an awful lot and America is not going to run out of it anytime soon. That's a good thing because demand is high and constant.

Natural gas is found in the subsurface in many sedimentary basins in the United States and across the world. Texas, Pennsylvania, Louisiana, Oklahoma, and West Virginia are America's leading natural gas producers.

Investing in Clean-Burning Natural Gas

There are numerous ways that investors can profit from natural gas. Let's divide them into several major types: Natural gas companies, gas transmission companies, master limited partnerships, exchange-traded funds, and natural gas futures.

As it turns out, the biggest natural gas producing companies are familiar to many. They include Shell (SHEL), BP (BP), Chevron CVX} and ExxonMobil (XOM). These firms also produce a large amount of oil, so if you are interested in keeping with a greener perspective, you may wish to invest in more purely natural gas explorers and producers. Some of these include Southwest Energy (SWN), Chesapeake Energy (CHK), Encana (ECA), and Devon Energy (DVN).

A great way to profit from the demand for natural gas is to invest in the pipeline companies that transport natural gas throughout the country. Many of these companies are structured as Master Limited Partnerships (MLPs) and payout extremely generous distributions. Some of the principal names include Targa Resource Partners LP (NGLS), Western Gas Partners (WES), and TCP Pipelines (TCP). Keep in mind that MLPs are treated a bit differently at tax time than most other companies, and you need to account for the K-1 form that they will provide you when filing your tax returns each year.

Another way to invest in natural gas is through natural gas index funds and exchange-traded funds. These securities invest in a basket of many companies involved in the natural gas space and can serve to minimize specific-company risk to your investment portfolio. Some of the names to research are Alerian Natural Gas MLP Index (ANGI) and the United States Natural Gas Fund (UNG).

Finally, if you are knowledgeable about the futures market and can accept the risks inherent in this form of investing, you might be interested in natural gas futures. Keep in mind that speculating in futures can involve a major risk of loss, as well as outsized profits.

In summary, profit opportunities are abundant and come in many shapes and sizes for those interested in investing in clean-burning natural gas. Good thing, because natural gas results in fewer atmospheric emissions compared to all other types of fossil fuels.

Source: https://www.askmoney.com/investing/invest-in-clean-burning-natural-gas?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex&ueid=9c0be2f8-1ff0-4873-b894-99aa7ae08179

0 Response to "Bidirectional Natural Gas Distribution System Design 2 Way Feeds"

Post a Comment